Georgia payroll tax calculator 2020

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Supports hourly salary income and multiple pay frequencies.

Income Tax Calculator For Fy 2020 21 Ay 2021 22 Excel Download

Payroll Taxes Taxes Rate Annual Max.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Process Payroll Faster Easier With ADP Payroll. To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Important note on the salary paycheck calculator. This includes tax withheld from. Get Started With ADP Payroll.

Employers have to pay a matching 145 of Medicare tax but only the. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB.

In the field Number of Payroll Payments Per Year enter 1. If you want to simplify payroll tax calculations you can. Rates include an administrative assessment of 006.

This 1099-G form is for. This guide is used to explain the guidelines for Withholding Taxes. Georgia new employer rate.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Your household income location filing status and number of personal exemptions. Check the 2020 Georgia state tax rate and the rules to calculate state income tax 5.

Content updated daily for ga payroll calculator. The median household income is 56183 2017. In the income box labelled 1 enter the annual salary of 10000000.

Ad Looking for ga payroll calculator. The Georgia State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Georgia State Tax CalculatorWe also provide State. For 2022 the minimum wage in Georgia is 725 per hour.

9 per year of the underpayment use Form 600 UET to compute the penalty and 5 of Georgia income tax imposed for the taxable year-48-7-120 and 48-7-126 The combined total of the. The tax calculator will automatically calculate the. Get Started With ADP Payroll.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Free for personal use. Calculate your state income tax step by step 6.

Ad Process Payroll Faster Easier With ADP Payroll. After a few seconds you will be provided with a full breakdown. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Georgia state has a population of just under 11 million 2020 and over half of its population live in its capital city Atlanta. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Taxpayers now can search for their 1099-G and 1099-INT on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. This free easy to use payroll calculator will calculate your take home pay. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Portugal Pension Income Tax Of Non Habitual Residents Kpmg Global

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

South Korea Earned Income Deduction Local Income Tax Kpmg Global

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

Payslip In The Netherlands How Does It Work Blog Parakar

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

Tax Deadline Extension What Is And Isn T Extended Smartasset

According To A Study Carried Out By Goodlord S Lettings Activity Tracker It Was Known That The Rental Market In Activity Tracker Marketing Property Marketing

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Foreigner S Income Tax In China China Admissions

State Corporate Income Tax Rates And Brackets Tax Foundation

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

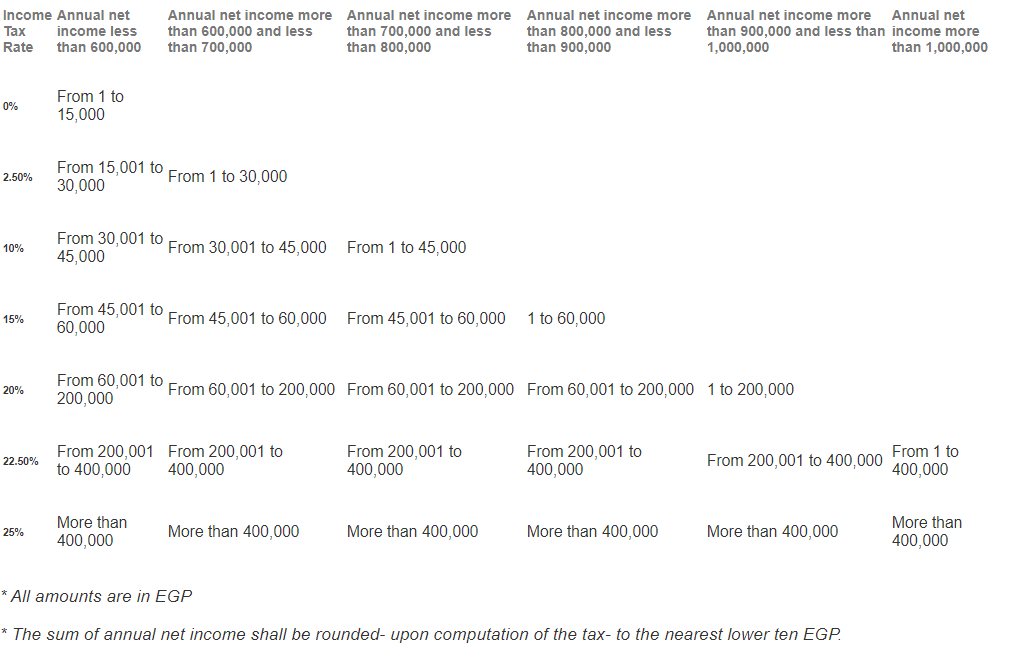

Egypt Amends Progressive Individual Income Tax Rates And Penalties Applicable On Tax Return Differences Ey Global

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Payroll Tax What It Is How To Calculate It Bench Accounting

Irs Releases Draft Form 1040 Here S What S New For 2020 Irs Forms Tax Return Income Tax Return

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty